Latest Insights

January 21, 2025

I recently attended the 18th EY Singapore Alternative Fund Symposium on 15 January 2025. The symposium featured various panels, fireside chats, and presentations from industry leaders, covering a wide range of topics relevant to the alternative investment sector in 2025.

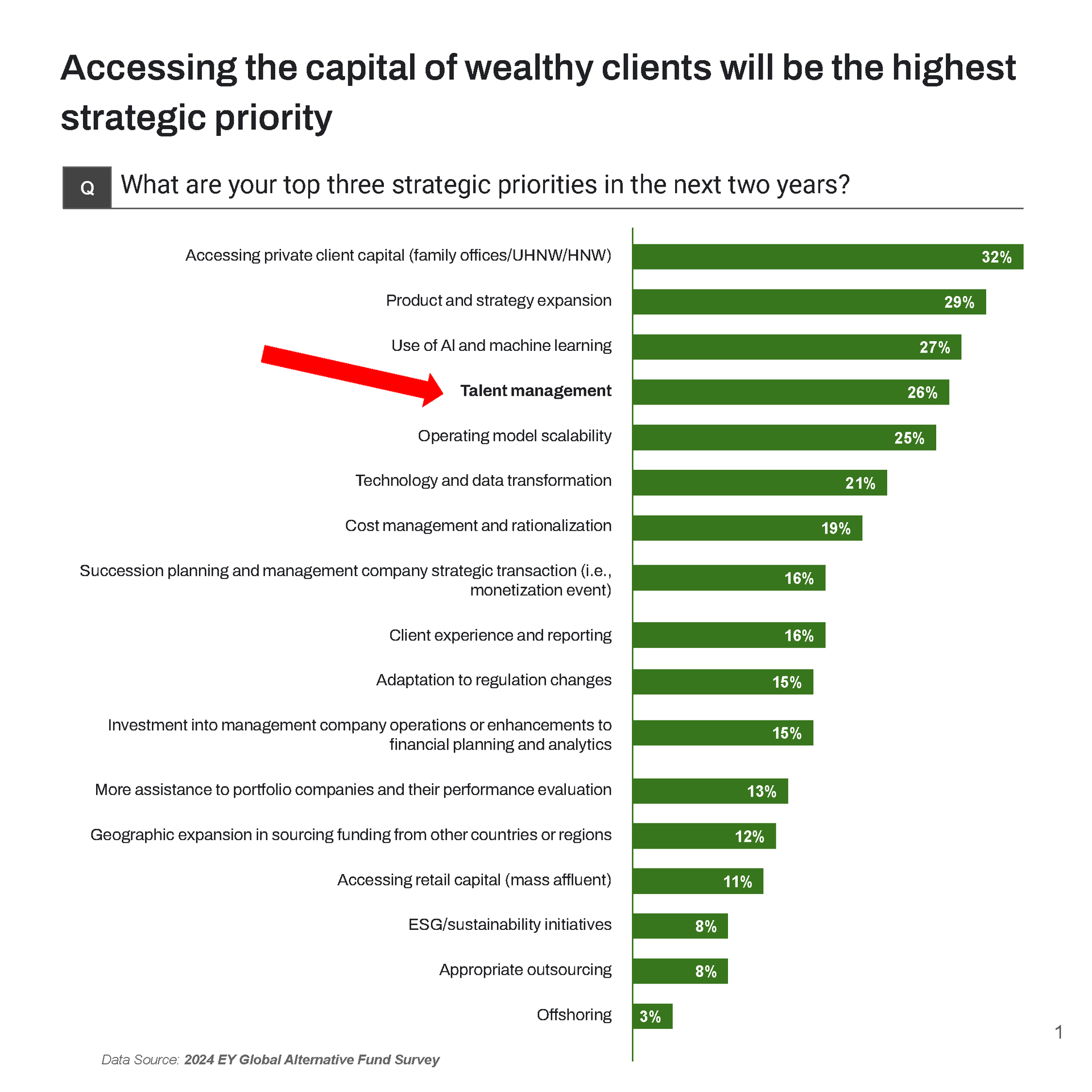

As someone in the talent industry, I was particularly drawn to this slide in the presentation:

"Alternative fund managers are prioritizing growth, technology and talent"

I went to download the latest

2024 EY Global Alternative Fund Survey to understand more, as I always keep a close eye on industry trends, particularly regarding talent.

The survey highlighted that talent management is one of the top five priorities for alternative fund managers, with a particular emphasis in the Asia-Pacific (APAC) region.

The survey also reveals that talent is a major strategic focus, especially in APAC where 37% of managers consider it an important goal. Despite AI's growing influence, firms with growth plans are looking to increase headcount, particularly in business development roles.

On the Ground

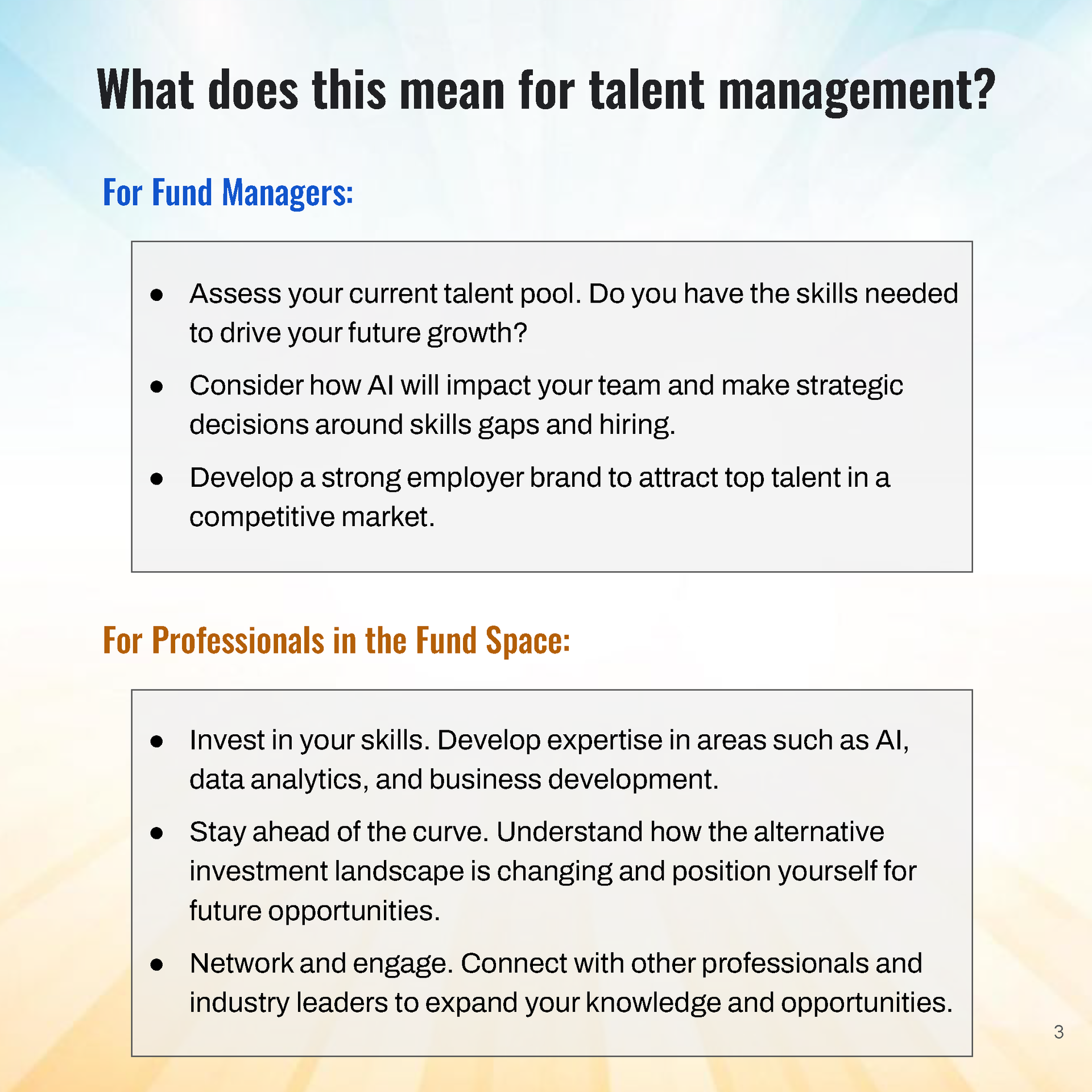

It's clear that talent management isn't just an HR issue – it's a

core strategic priority for alternative fund managers. This means the competition for top talent is going to be fierce, and firms need to be proactive to attract and retain the best people.

I would just like to highlight the point of

developing strong employer brand from a recent coffee chat with an investment professional.

When he mentioned declining a recent job offer, I asked which firm it was. His response triggered an involuntary "Oh, I see" reaction from me—a reaction that piqued his curiosity. I explained that this particular firm had been hiring for the same position over a while.

He laughed knowingly and confirmed this was precisely why he had declined their offer. While I played devil's advocate and suggested it could be due to misalignment in the talent hiring process (note: they weren't our client - when firms work with us,

we advise them on strategic positioning and employer branding), he revealed he had conducted extensive due diligence, including direct conversations with his potential predecessor to understand the underlying dynamics….

Word of Thoughts

The market does ‘talk’, which is why organizations work with experienced professionals who can help them build not just teams, but sustainable employer brands that attract and retain the best talent.

Enjoy the slides below for more details!

(click on the arrows to navigate)

About the Author

Share This Article

Articles You May Like