Latest Insights

January 9, 2020

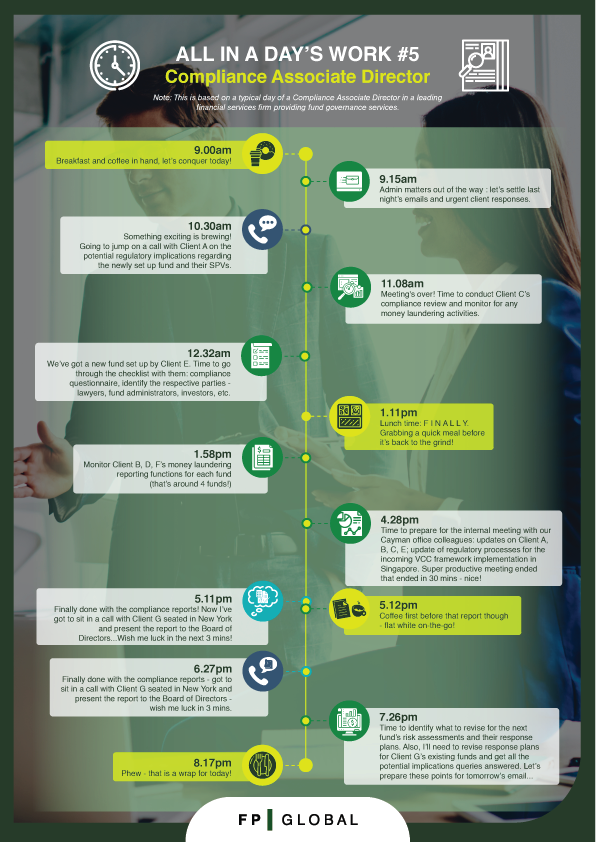

Does compliance in the funds industry mean an endless stream of reports and crisis management?

How much time is spent at one’s desk and how much of it is at conference calls?

Save yourself the legwork of finding out – we do the snooping so you can make better-informed decisions!

Check out our first 2020 edition of AIADW!

9.00am: Breakfast and coffee in hand, let’s conquer today!

9.15am: Admin matters out of the way : let’s settle last night’s emails and urgent client responses.

10.30am: Something exciting is brewing! Going to jump on a call with Client A on the potential regulatory implications regarding the newly set up fund and their SPVs.

11.08am: Meeting’s over! Time to conduct Client C’s compliance review and monitor for any money laundering activities.

12.32am: We’ve got a new fund set up by Client E. Time to go through the checklist with them: compliance questionnaire, identify the respective parties – lawyers, fund administrators, investors, etc.

1.11pm: Lunch time: F I N A L L Y. Grabbing a quick meal before it’s back to the grind!

1.58pm: Monitor Client B, D, F’s money laundering reporting functions for each fund (that’s around 4 funds!)

4.28pm: Time to prepare for the internal meeting with our Cayman office colleagues: updates on Client A, B, C, E; update of regulatory processes for the incoming VCC framework implementation in Singapore. Super productive meeting ended that ended in 30 mins – nice!

5.11pm: Mental note: prepare the compliance report for Client D and wrap up yesterday’s report for Client G.

5.12pm: Coffee first before that report though – flat white on-the-go!

6.27pm: Finally done with the compliance reports! Now I’ve got to sit in a call with Client G seated in New York and present the report to the Board of Directors…Wish me luck in the next 3 mins!

7.26pm: Time to identify what to revise for the next fund’s risk assessments and their response plans. Also, I’ll need to revise response plans for Client G’s existing funds and get all the potential implications queries answered. Let’s prepare these points for tomorrow’s email…

8.17pm: Phew – that is a wrap for today!

About the Author

Share This Article

Articles You May Like