Latest Insights

March 10, 2020

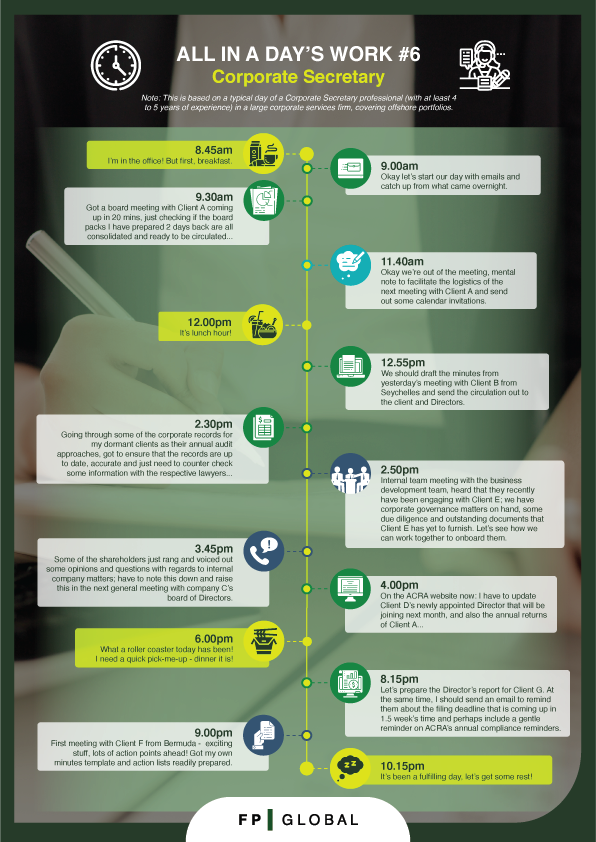

Ever dreamt of being a Corporate Secretary? Ever wondered what secretary roles entail? Does being a secretary only consist of menial tasks like arranging for meetings, taking down minutes and running after the bosses?

Discover what exactly goes on in a typical day at work as a Corporate Secretary in this next series of AIADW:

8.45am: I’m in the office! But first, breakfast.

9.00am: Okay let’s start our day with emails and catch up from what came overnight.

9.30am: Got a board meeting with Client A coming up in 20 mins, just checking if the board packs I have prepared 2 days back are all consolidated and ready to be circulated…

11.40am: Okay we’re out of the meeting, mental note to facilitate the logistics of the next meeting with Client A and send out some calendar invitations.

12.00pm: It’s lunch hour!

12.55pm: We should draft the minutes from yesterday’s meeting with Client B from Seychelles and send the circulation out to the client and Directors.

2.30pm: Going through some of the corporate records for my dormant clients as their annual audit approaches; got to ensure that the records are up to date, accurate, and just need to counter check some information with the respective lawyers…

2.50pm: Internal team meeting with the business development team, heard that they recently have been engaging with Client E; we have corporate governance matters on hand, some due diligence and outstanding documents that Client E has yet to furnish. Let’s see how we can work together to onboard them.

3.45pm: Some of the shareholders just rang and voiced out some opinions and questions with regards to internal company matters; have to note this down and raise this in the next general meeting with company C’s board of Directors.

4.00pm: On the ACRA website now: I have to update Client D’s newly appointed Director that will be joining next month, and also the annual returns of Client A…

6.00pm: What a roller coaster today has been! I need a quick pick-me-up – dinner it is!

8.15pm: Let’s prepare the Director’s report for Client G. At the same time, I should send an email to remind them about the filing deadline that is coming up in 1.5 week’s time and perhaps include a gentle reminder on ACRA’s annual compliance reminders.

9.00pm: First meeting with Client F from Bermuda – exciting stuff, lots of action points ahead! Got my own minutes template and action lists readily prepared.

10.15pm: It’s been a fulfilling day, let’s get some rest!

About the Author

Share This Article

Articles You May Like