Latest Insights

August 6, 2019

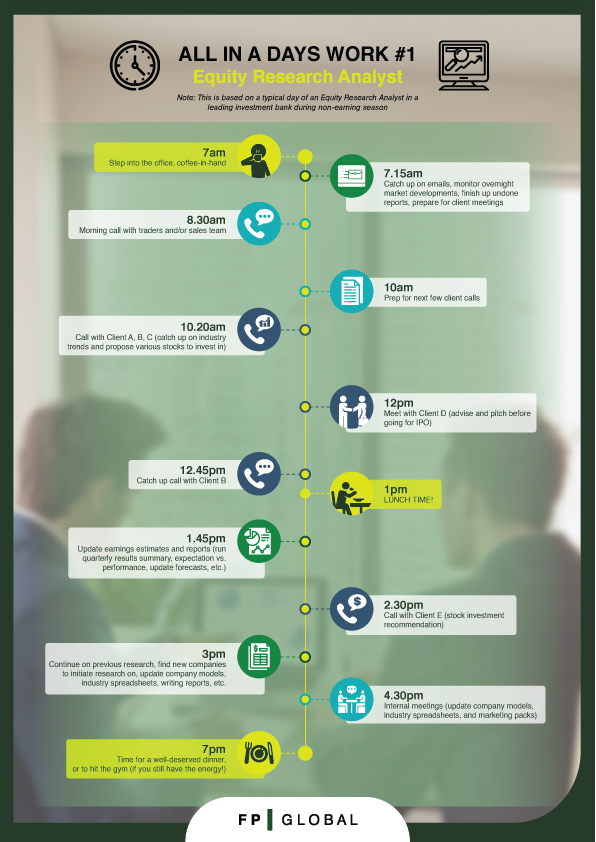

Do equity research analysts constantly need to monitor market data? Is 75% of their time spent speaking to external clients to give investment advice? To what extent is research and financial reports a part of their daily routine?

If you aspire to be an equity research analyst, here’s your opportunity to step into their shoes and discover how a typical day-at-work pans out for them!

While there are some differences between a buy-side and a sell-side candidate, there are general similarities for both – they tend to focus on a niche industry. Based on that, they monitor market data and news reports closely, speak to relevant companies to update their research daily and deliver recommendations afterwards.

Note: This is based on a typical day of an Equity Research Analyst in a leading investment bank (sell-side) during non-earning season. Let’s begin their day!

7am: Step into the office, coffee-in-hand

7.15am: Catch up on emails, monitor overnight market developments, finish up undone reports, prepare for client meetings

8.30am: Morning call with traders and/or sales team

10am: Prep for next few client calls

10.20am: Call with Client A, B, C (catch up on industry trends and propose various stocks to invest in)

12pm: Meet with Client D (advise and pitch before going for IPO)

12.45pm: Catch up call with Client B

1pm: LUNCH TIME! (usually a quick one around the corner or take-away)

1.45pm: Update earnings estimates and reports (run quarterly results summary, expectations vs. performance, update forecasts, etc.)

2.30pm: Call with Client E (stock investment recommendation)

3pm: Continue on previous research, find new companies to initiate research on, update company models, industry spreadsheets, writing reports, etc.

4.30pm: Internal meetings (update company models, industry spreadsheets, and marketing packs)

7pm: Time for a well-deserved dinner, or to hit the gym (if you still have the energy!)

About the Author

Articles You May Like

Talent is King (and Queen) in Alternatives: Insights from the 2024 EY Global Alternative Fund Survey

Capabilities

Executive Search

LEADERSHIP TRAINING & CONSULTANCY

People

Expertise

FP GLOBAL PTE. LTD. Licence Number: 22C0953