Latest Insights

November 12, 2019

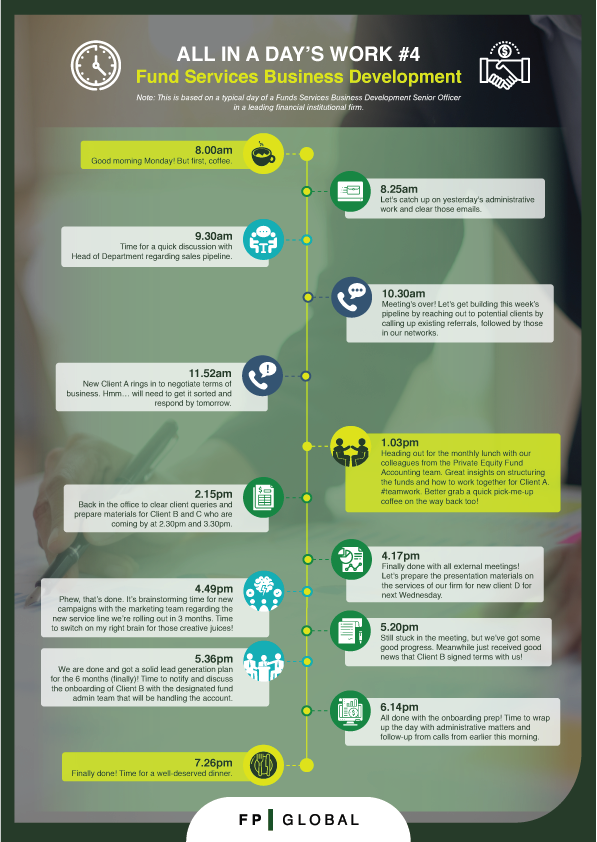

Does being a business development professional in the funds industry mean all cold calls and client meetings? How much desk work is required? Do they even have a social life?

Find out why teamwork and administrative duties are equally important in the long-run of lead generation and relationship management with clients!

We break it down for you in our fourth edition of #AIADW.

Note: This is based on a typical day of a Funds Services Business Development Senior Officer in a leading financial institutional firm.

8.00am: Good morning Monday! But first, coffee.

8.25am: Let’s catch up on yesterday’s administrative work and clear those emails.

9.30am: Time for a quick discussion with Head of Department regarding sales pipeline.

10.30am: Meeting’s over! Let’s get building this week’s pipeline by reaching out to potential clients by calling up existing referrals, followed by those in our networks.

11.52am: New Client A rings in to negotiate terms of business. Hmm… will need to get it sorted and respond by tomorrow.

1.03pm: Heading out for the monthly lunch with our colleagues from the Private Equity Fund Accounting team. Great insights on structuring the funds and how to work together for Client A. #teamwork. Better grab a quick pick-me-up coffee on the way back too!

2.15pm: Back in the office to clear client queries and prepare materials for Client B and C who are coming by at 2.30pm and 3.30pm.

4.17pm: Finally done with all external meetings! Let’s prepare the presentation materials on the services of our firm for new client D for next Wednesday.

4.49pm: Phew, that’s done. It’s brainstorming time for new campaigns with the marketing team regarding the new service line we’re rolling out in 3 months. Time to switch on my right brain for those creative juices!

5.20pm: Still stuck in the meeting, but we’ve got some good progress. Meanwhile just received good news that Client B signed terms with us!

5.36pm: We are done and got a solid lead generation plan for the 6 months (finally)! Time to notify and discuss the onboarding of Client B with the designated fund admin team that will be handling the account.

6.14pm: All done with the onboarding prep! Time to wrap up the day with administrative matters and follow-up from calls from earlier this morning.

7.26pm: Finally done! Time for a well-deserved dinner.

About the Author

Share This Article

Articles You May Like