Latest Insights

September 10, 2019

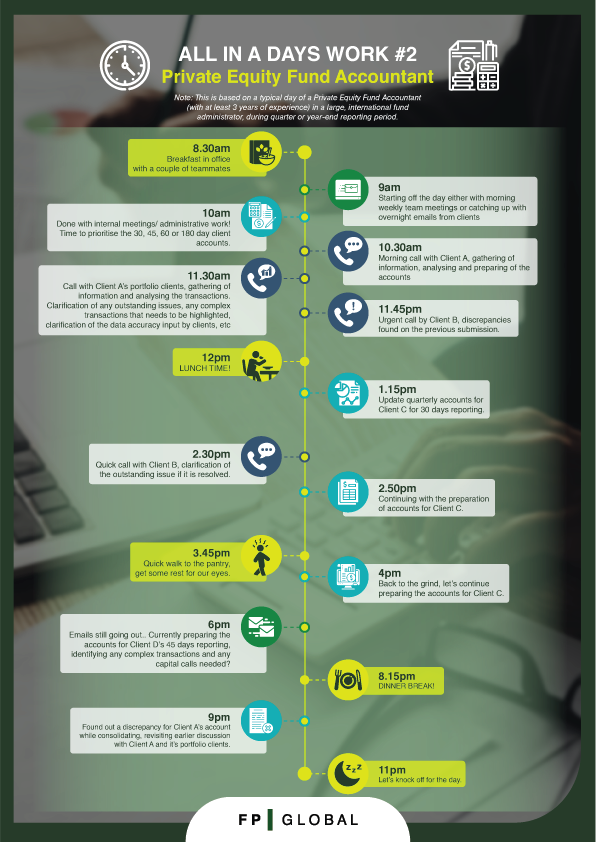

So what’s a day-in-the-life of a fund accountant? Is it all excel sheets and balancing accounts? How much time is spent at your desk preparing quarterly accounts for 30, 45, 60, 180 day cycles? To what extent is juggling multiple calls and complex transactions with clients a main thing? Is there even time for lunch or dinner? What time can I actually hit the sack?

If you aspire to be a Fund Accountant in Private Equity, here’s your opportunity to step into their shoes and discover how a typical day-at-work pans out for them!

In none other than our second edition of #AIADW, we present to you our findings based on first-hand insights from our hundreds of candidates across industries!

This is based on a typical day of a Private Equity Fund Accountant (with at least 3 years of experience) in a large, international fund administrator, during quarter or year-end reporting period.

8.30am: Breakfast in the office with a couple of teammates.

9.00am: Starting off the day either with morning weekly team meetings or catching up with overnight emails from clients

10.00am: Done with internal meetings/ administrative work! Time to prioritise the 30, 45, 60 or 180 day client accounts.

10.30am: Morning call with Client A, gathering of information, analysing and preparing of the accounts

11.30am: Call with Client A’s portfolio clients, gathering of information and analysing the transactions. Clarification of any outstanding issues, any complex transactions that needs to be highlighted, clarification of the data accuracy input by clients, etc

11.45am: Urgent call by Client B, discrepancies found on the previous submission.

12.00pm: LUNCH TIME!

1.15pm: Update quarterly accounts for Client C for 30 days reporting.

2.30pm: Quick call with Client B, clarification of the outstanding issue if it is resolved.

2.50pm: Continuing with the preparation of accounts for Client C.

3.45pm: Quick walk to the pantry, get some rest for our eyes.

4.00pm: Back to the grind, let’s continue preparing the accounts for Client C.

6.00pm: Emails still going out..Currently preparing the accounts for Client D’s 45 days reporting, identifying any complex transactions and any capital calls needed?

8.15pm: Dinner break!

9.00pm: Found out a discrepancy for Client A’s account while consolidating, revisiting earlier discussion with Client A and it’s portfolio clients.

11.00pm: Let’s knock off for the day.

About the Author

Articles You May Like

Talent is King (and Queen) in Alternatives: Insights from the 2024 EY Global Alternative Fund Survey

Capabilities

Executive Search

LEADERSHIP TRAINING & CONSULTANCY

People

Expertise

FP GLOBAL PTE. LTD. Licence Number: 22C0953