Latest Insights

June 17, 2020

Congrats, you’ve got the first one in the bag. We can’t promise you that it’ll be much easier hereon, but now that you’ve got a glimpse of the rigour involved, we’re confident that you’ll be able to take this in your stride. Deep-diving into fixed income and portfolio management, we help you break down how to tackle these 21 item set questions in three hours, and how to best prepare yourself to ace this, a second round.

Curriculum Weightage:

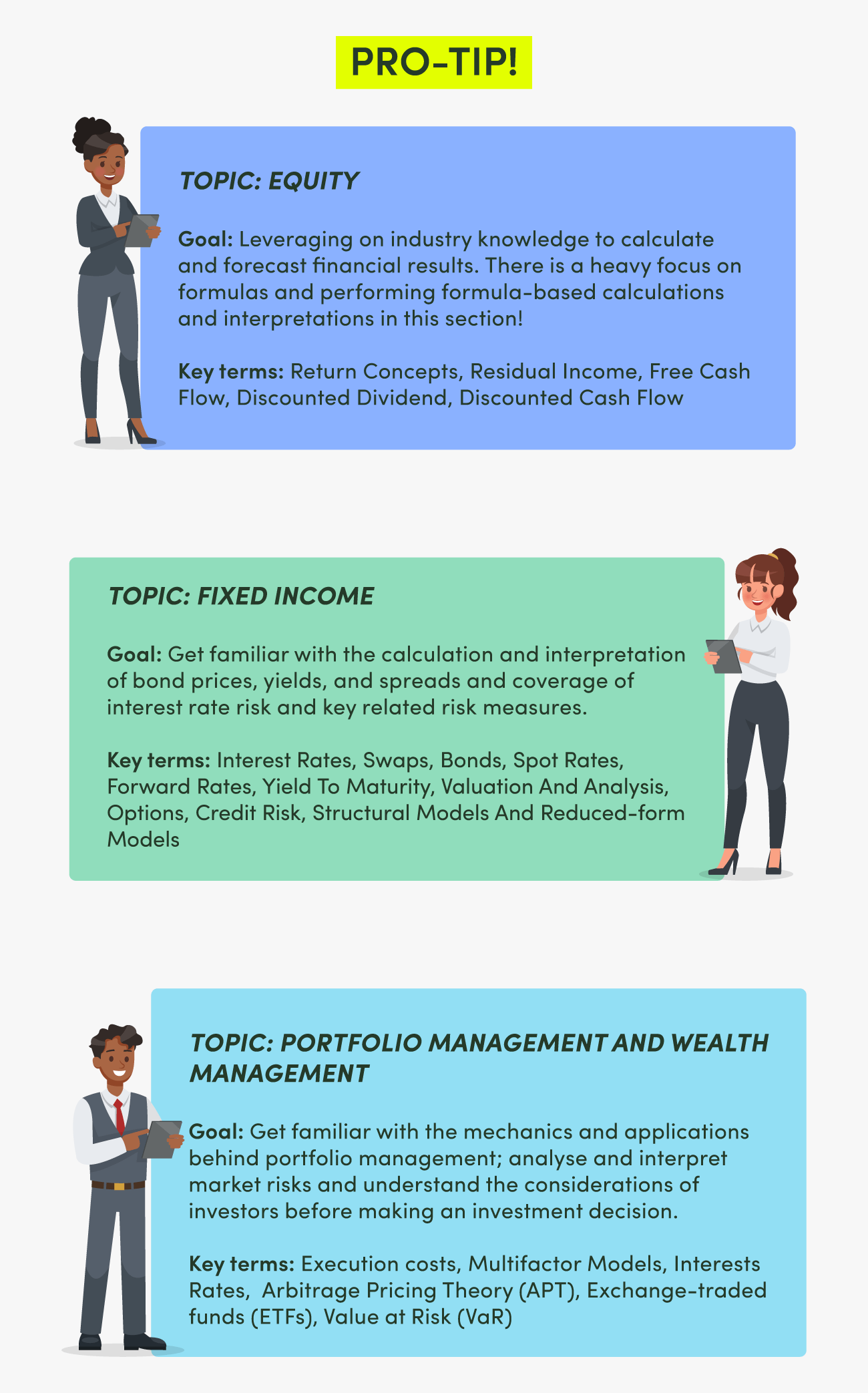

The curriculum weightage is the key for anyone preparing for the CFA exams! In addition to the topics on “Ethical & Professional Standard” and “Financial Reporting & Analysis”, topics “Equity” , “Fixed Income” and “Portfolio management and Wealth Management” are set to weigh the most in the coming CFA Level II paper, students are advised to spend more study time on the concepts and tools on the above topics.

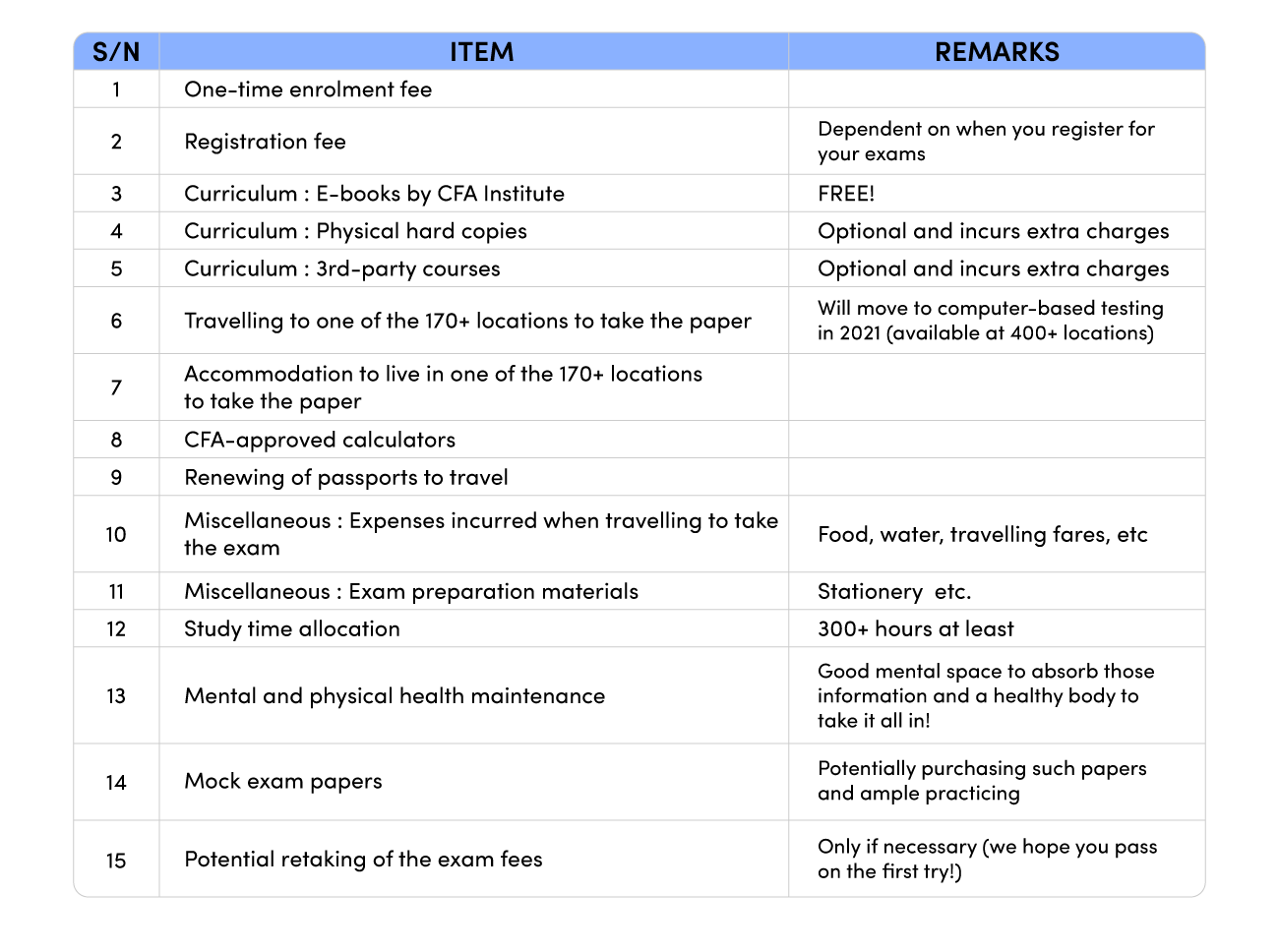

Costs Incurred:

We are certain you would be able to find countless of articles about how much it costs financially to take the CFA Level II paper but here we summarised a whole list of costs (financially, effort, time, etc) that you would have to pay for as you attempt your paper:

Exam Duration & Question Format

Did you know that the CFA paper 1 is split into two sessions – one in the morning and one in the afternoon? Intensive period indeed.

- a) Morning: 120 questions (3 hours)

- b) Afternoon: 120 questions (3 hours)

That means you have approximately 1.5 minute to attempt every question. These are mutually exclusive questions with three available answers per question in a similar format below:

Which of the following is least likely to be considered as an alternative investment?

- Real Estate

- Commodities

- Long-only Equity Funds

Release of Results

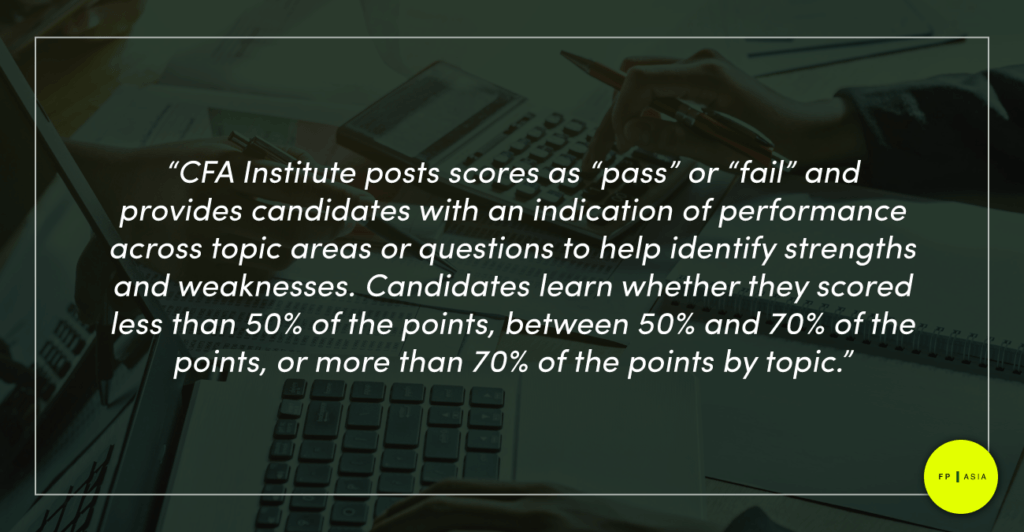

The most nerve-wracking part of CFA Paper 1 only occurs 60 days after completing the exams – the release of the Exam Results. The minimum passing score for the CFA level 1 paper is never disclosed, says CFA institute (we are assuming it is based on the intake’s bell curve!) but we encourage candidates to aim minimally 70% of the points by topic to try to be among the right hand side of the bell-curve!

Read more on the above quote here. If you need any help in understanding how to read your topic area performance summary then read the official release by CFA Institute here.

Last but not least, Funds Partnership Asia wishes all candidates taking their CFA Level 1 paper the best of luck but always remember: Exams are always going to happen. You are either going to pass or fail but that one word does not get to decide your future!

Share This Article

Articles You May Like