Latest Insights

July 9, 2020

They always say it’s not about how you start, but the end that counts! With two milestones in the bag and the last one to go, we’re not about to leave you in the lurch. What should students focus on in order to ace this? How many questions do they have to tackle in the short period of time? Read on to find out:

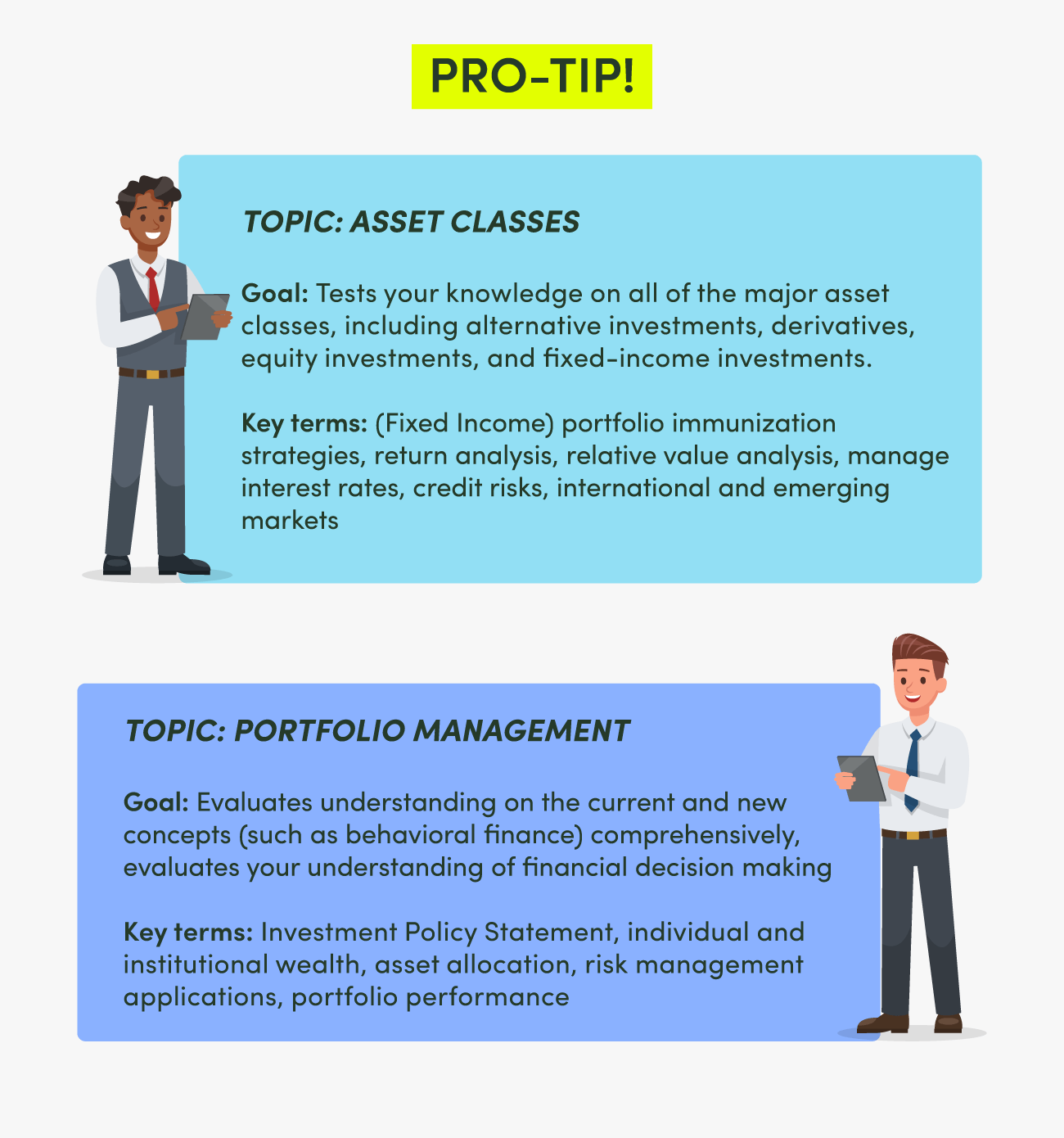

Curriculum Weightage:

The curriculum weightage is the

key

for anyone preparing for the CFA exams! There’s heavy focus on “Portfolio Management” and “Fixed Income” in the upcoming CFA Level III however students are advised to spend more study time on the concepts and tools on the above topics.

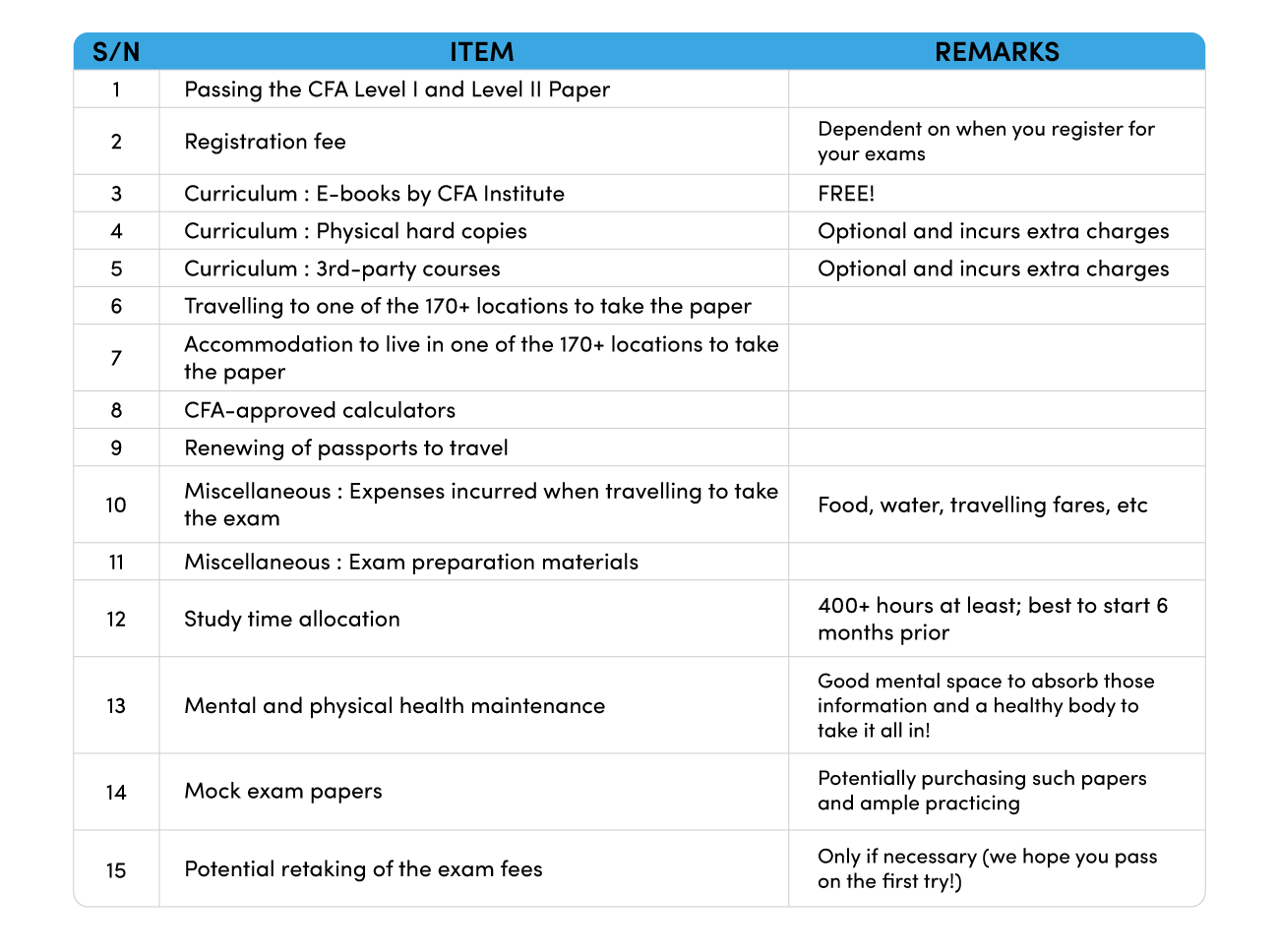

Costs Incurred:

We are certain you would be able to find countless of articles about how much it costs financially to take the CFA Level III paper but here we summarised a whole list of costs (financially, effort, time, etc) that you would have to pay for as you attempt your paper:

Exam Duration & Question Format

You can expect a total of 20 to 30 mini case studies that totals to 60 multiple-choice questions plus essay questions:

- Morning session is 3 hours long:

- Essay questions (typically around 8 and 12 case studies)

- Each question has several subparts

- 2 types of answer pages:

- Unlined pages will be clearly labeled for specified questions. You are free to write your response as needed on that page.

- Structured set of boxes that are clearly labeled for that question part and provide a visual structure to guide you in writing your responses.

- tallies to a total of maximum of 180 points (dependent on the questions)

- Afternoon session:

- Multiple Choice Questions

- 11 case studies

- 8 case studies with 6 questions each

- 3 case studies with 4 questions each

See sample of the format below:

Sample Questions for the morning session:

Questions 1 and 2 are related to XXX and YYY; A total of 27 mins have been allocated to these 2 questions and candidates should answer in the order presented.

Question 1 has a total of 2 parts (A and B) for a total of 12 minutes.

Case Scenario depicted half a page later.

- Determine whether the risk tolerance of the Plan is below-average or above-average Justify your response with two reasons.

Note: Restating case facts is an incomplete justification and will not receive credit.

5 minutes (Answer 1-A on page 3)

- State the minimum return requirement of the Plan. Explain your response.

4 minutes (Answer 1-B on page 4)

Have a look at CFA’s official sample questions here.

Sample Questions for the afternoon session:

Questions 1 to 6 relate to Ethical and Professional Standards.

XXX Case Scenario

1.5 to 2 pages later…

In which of the following actions does XXX most likely comply with the requirements and recommendations of the CFA Institute Standards of Professional Conduct? When XXX:

- References the CFA program and designation.

- Provides performance information on the advisor’s website.

- References the enhanced portfolio management skills of his teams

Which of the company’s policies regarding public appearances is least likely consistent with both the requirements and recommendations of the CFA Institute Research Objectivity Standards?

- Statement 1

- Statement 2

- Statement 3

So on and forth for Question 3 to 6. Or have a look at CFA’s official sample questions here.

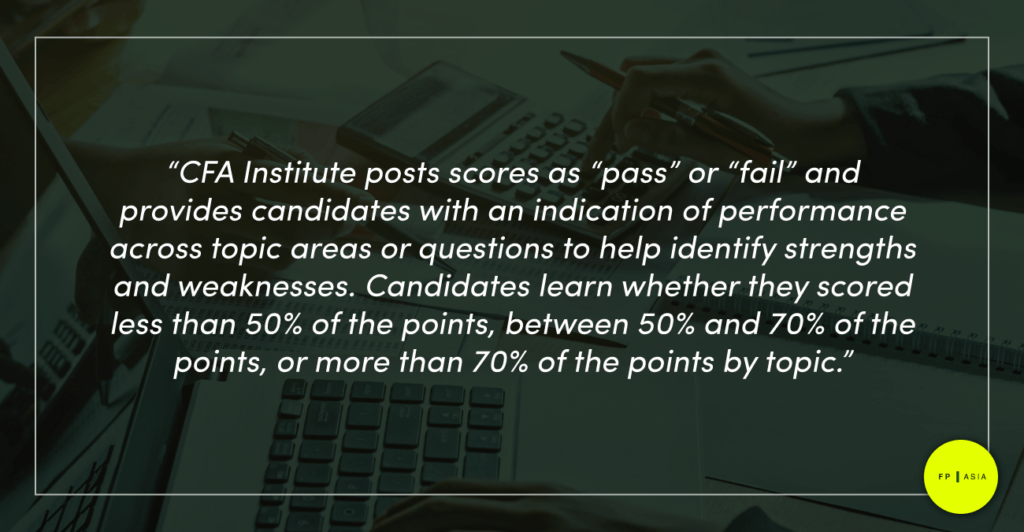

Release of Results

The most anxious part of this examination only occurs 90 days after completing the exams : Release of the Exam Results. The minimum passing score for the CFA Level III paper is never disclosed, says CFA institute (we are assuming it is based on the intake’s bell curve!) but we encourage candidates to aim minimally 70% of the points by topic to try to be amongst the right hand side of the bell-curve!

Read more on the above quote here. If you need any help in understanding how to read your topic area performance summary then read the official release by CFA Institute here.

Last but not least, Funds Partnership Asia wishes all candidates taking their CFA Level III paper good luck but always remember: Exams are always going to happen. You are either going to pass or fail but that one sheet won’t decide your future!

Share This Article

Articles You May Like