Latest Insights

August 26, 2021

Hiring the right candidate is a pretty difficult and daunting task. Whether this is a new position or a replacement role, businesses are always faced with the same dilemma – to hire base on experience or the potential of an individual. While many seek comfort and assume that one’s relevant experience is able to increase the said productivity, others prefer the value that an individual can bring to the firm. Either way, it does not, however, eliminate the possibility of making a poor hiring decision.

The implications of poor hiring decisions do COST the company. The costs are not limited to the wasted salary spent on the individual or the agency recruitment costs incurred but here are some hidden costs that firms incur too :

- Salary settlement and severance packages

- Induction and Training costs

- Job advertisement costs

- Agency replacement fees

- Internal referral rewards

- Lost productivity of co-workers and supervisors

- Impact on staff morale

- Loss of business/ Loss of revenue opportunities

- Negative impact on reputation and branding

- Fraudulent activities committed by bad hires.

So how can we then hire right?

Train from Scratch or Hit the Ground Running

Well, this highly depends on the context of the hire.

Consider these two scenarios:

Scenario 1: You have a new fund that is due to launch in a month’s time and require an Associate with at least 4 years of relevant experience in the same industry you invest in, chances are that you would be looking at a candidate with at least 6 to 8 years of total working experience, drawing a base salary + an average of 4 to 6 months bonus. With the existing resources, you figure that you are able to cope in the meantime whilst you find this hire.

In comparison, Scenario 2: You have recently received a resignation letter from a staff who is in a fund operations function and has been with the firm for 5 years; 3 years of leading a team of 2. As the Department Head, you are probably now scratching your head on how to find a replacement during this one month notice and furthermore, realise the next reporting period is due at the same timeframe. Chances are that you would need to find an individual who is ideally available on short notice to pick up the pace and have some prior experience in leading junior staff.

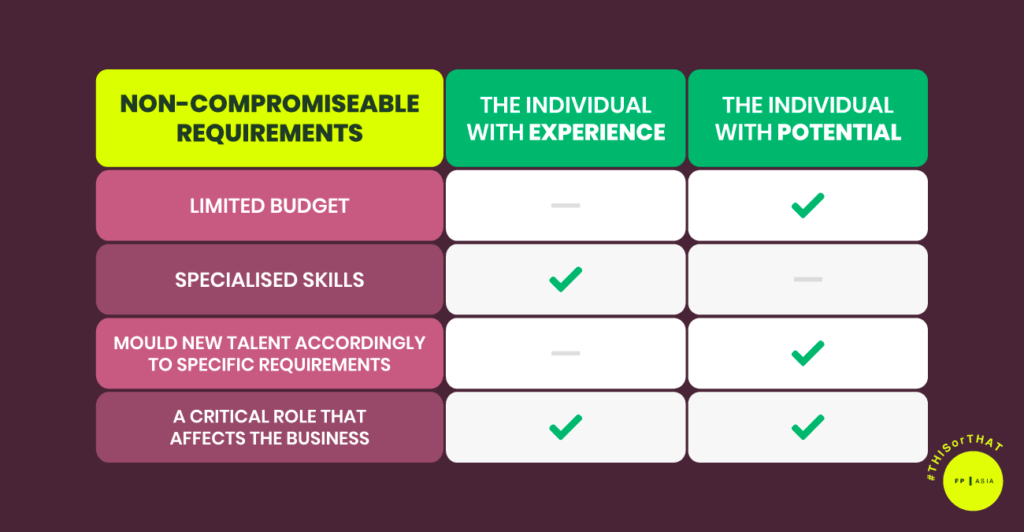

Given the two scenarios, there are clear differences in the type of skills you are looking for, the urgency of this hire, and the relevancy of prior experience the individual would possess. So who do we hire? The individual with experience or the one with potential?

A key thing to identify in either scenario is the non-compromisable requirement of this hire. Especially during a replacement hire, we sometimes subconsciously compare potential candidates to the ones who got away – oftentimes, we sometimes take for granted are the habits our talent developed during the course of being with the firm.

Identifying these requirements gives hiring managers and the talent acquisition team a clear direction on the search parameters. The table below are some common requirements that we can easily identify during the course of our 15-year history of working on thousands of roles:

Once the firm has identified which are the critical requirements of the search, the business then will have a clearer direction on whether to engage a recruitment agency, define and decide on the type of agency that best able to fulfill this hiring need, and the type of search.

A key point to also consider is the urgency of the hire. This requirement typically would be prioritised before the above-stated in the table which then necessitates a fair compromise between the potential employers and employees. Partnering with an agency like Funds Partnership Asia is always favourable for both parties as the consultant is able to objectively assess the situation and advise accordingly!

If you are still in your dilemma, Funds Partnership Asia has a specialised team of consultants for every function in the funds business. We encourage you to get in touch with Daphne at daphne@fundspartnership.com or Ayyaz ayyaz@fundspartnership.com if you need to pick our brains (or two!).

Share This Article

Articles You May Like