Latest Insights

April 10, 2023

Director's Note

Asset management firms in Asia Pacific are expected to increase their hiring efforts in 2023. The growing demand for ESG-focused professionals, the need for technology professionals to support digital transformation, the demand for distribution professionals to expand reach in the region, and the increasing importance of compliance and risk management are the main drivers of this trend.

Sustainable investing has become a hub in the Asia Pacific region, leading to a surge in the demand for ESG analysts, portfolio managers, and investment strategists. Technology is playing a more significant role in the industry, leading to a demand for professionals with expertise in coding, data analysis, and cybersecurity. Distribution professionals are also required with strong connections across the region.

To stay competitive in a rapidly evolving industry, it is crucial for asset management firms to attract talent that can adapt to emerging trends such as sustainable investing, digital transformation, and meet regulatory obligations. The ability to hire the right talent would determine firms' capacity to stay relevant and meet the needs of a diverse investor base across the region.

At Funds Partnership, we are committed to helping our clients stay competitive in this rapidly evolving industry. Our Asia Pacific salary guide is an essential resource for firms looking to attract and retain top talent, and stay up-to-date with the latest industry trends and best practices.

Market Overview

The asset management industry has been experiencing significant changes in recent years, and these trends are expected to continue in the Asia Pacific (APAC) region. One of the major trends is the rise of exchange-traded funds (ETFs), which offer lower fees and better liquidity than traditional mutual funds. As a result, traditional asset managers are facing increased pressure to reduce fees and offer more passive investment options for their clients. This trend may lead to a decrease in salary for active fund managers, as passive strategies become more popular.

Another trend is the growing importance of environmental, social, and governance (ESG) investing. Investors are increasingly demanding that their portfolios align with their values, and asset managers are responding with more ESG-focused investment solutions. This trend may lead to an increase in salary for ESG professionals, as they become more valuable to the industry.

Finally, the increasing adoption of technology and automation is transforming the way asset managers work. Technology is enabling greater efficiency and cost reductions, but it also means that some roles may become redundant. This trend may lead to a decrease in salary for roles that can be automated or outsourced.

Overall, the market trends in the asset management industry are likely to have an impact on salaries in the APAC region, with some roles seeing increases and others seeing decreases depending on the specific trends affecting the industry.

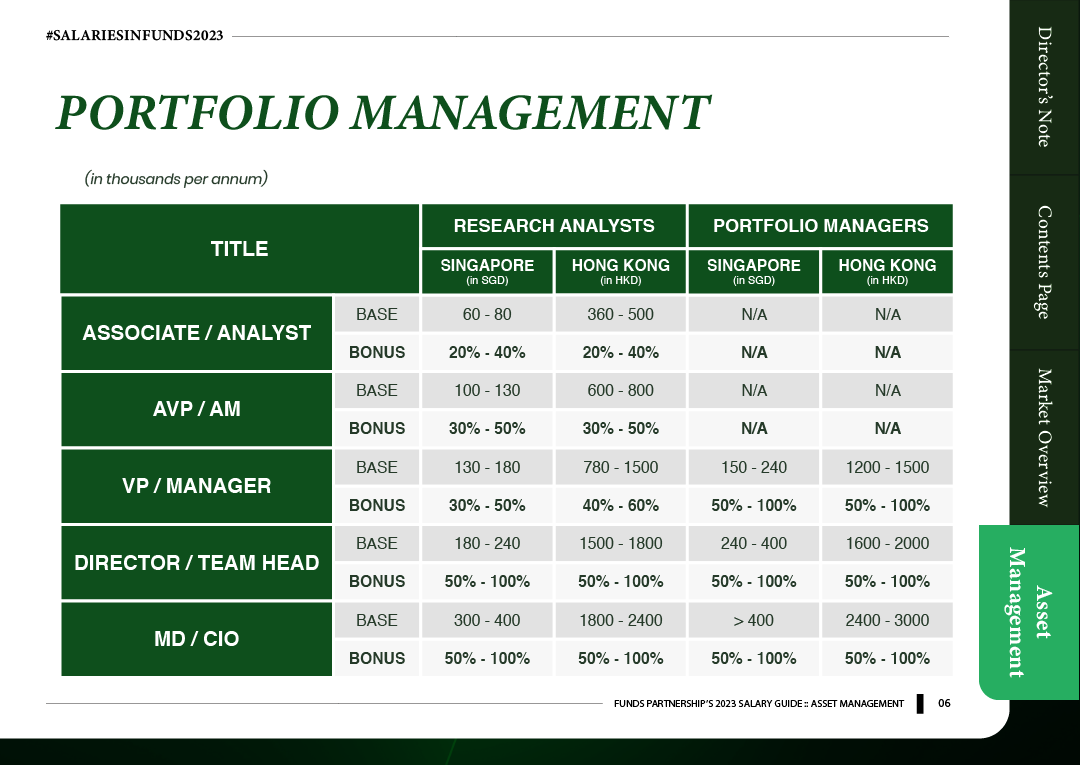

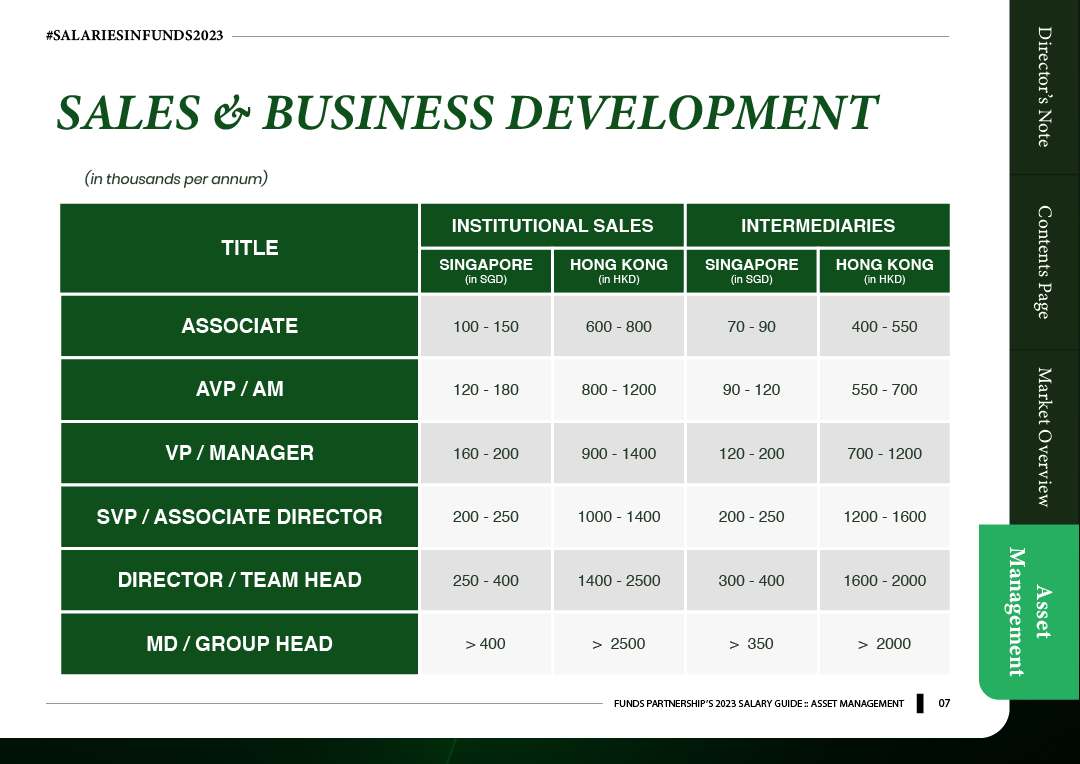

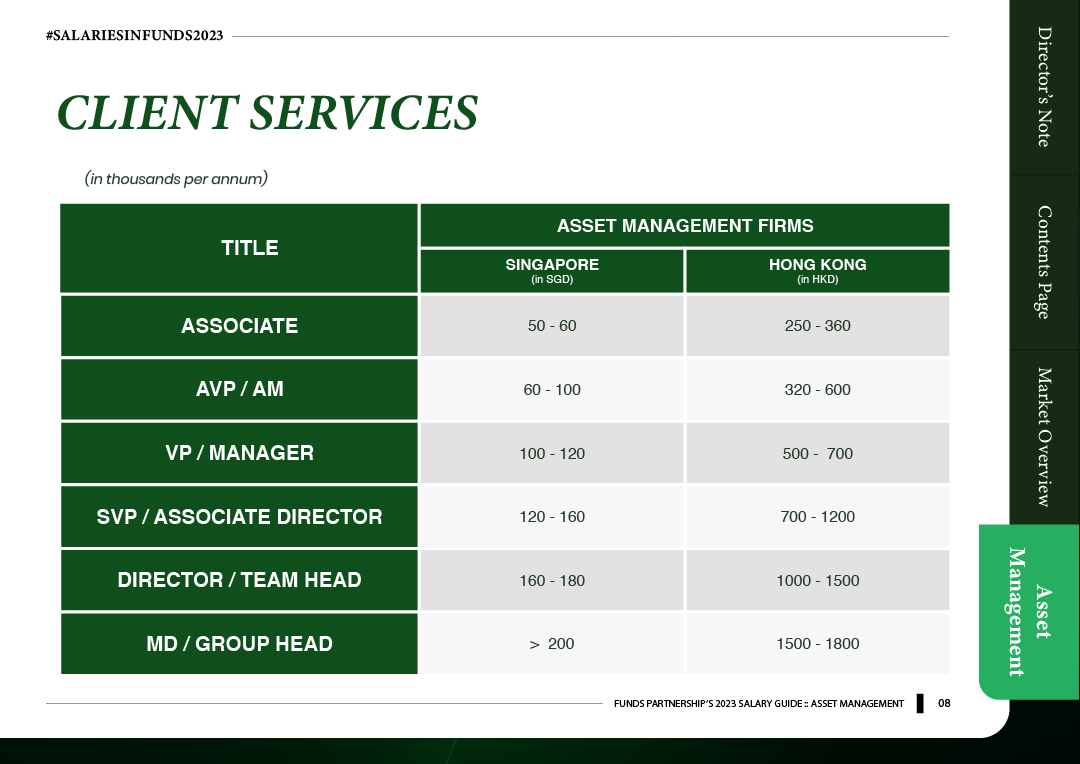

Salary Guide

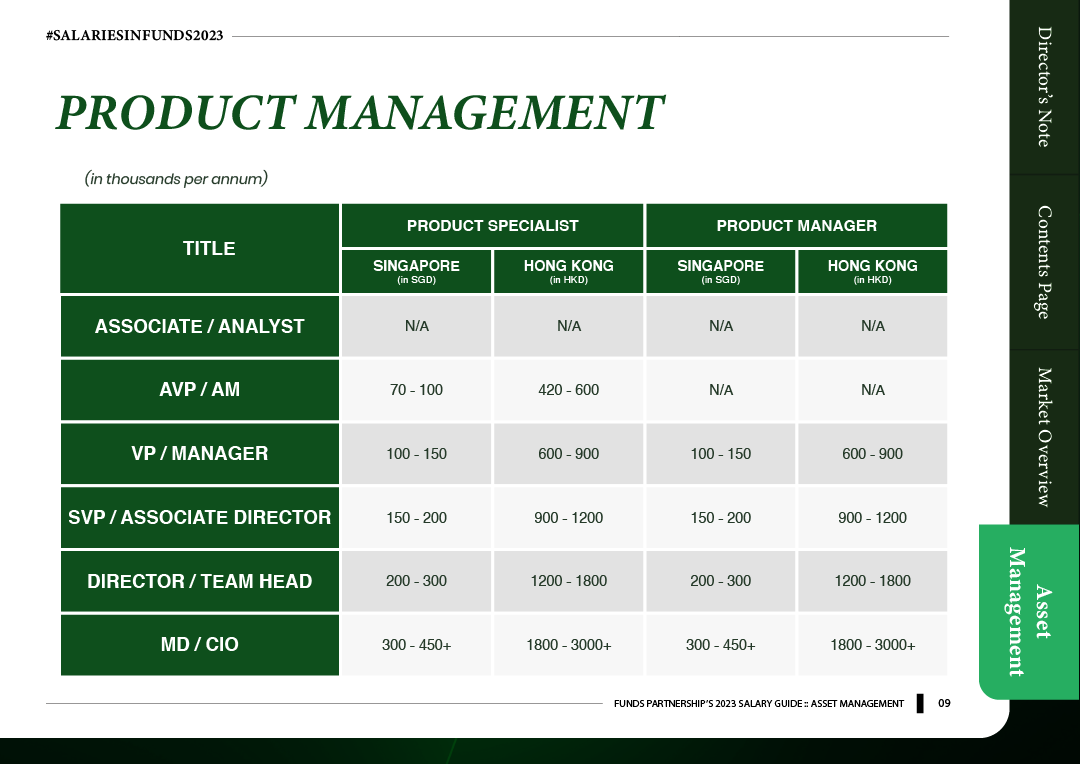

Download the PDF version of the Funds Partnership 2023 Asset Management Salary Guide here: Funds Partnership 2023 Salary Guide: Asset Management

To find out more about the Asset Management industry, get in touch with our specialist:

Articles You May Like

Talent is King (and Queen) in Alternatives: Insights from the 2024 EY Global Alternative Fund Survey

Capabilities

Executive Search

LEADERSHIP TRAINING & CONSULTANCY

People

Expertise

FP GLOBAL PTE. LTD. Licence Number: 22C0953