Latest Insights

October 12, 2023

I recently attended a seminar on the costs of living and business costs in Singapore. The presenter analyzed various expense categories like logistics, utilities, rentals and importantly, wages. Tight labor market conditions have pushed wage growth above pre-pandemic norms, intensifying the war for talent.

This got me thinking about the options available to fund services clients who are considering adopting an offshoring model for their fund services expansion plan. When deciding whether to have the full team in one location or to explore an outsourcing model (which is quite common among fund administrators), several factors come into play, including the type of talent available, the cost considerations, cultural fit, and language requirements.

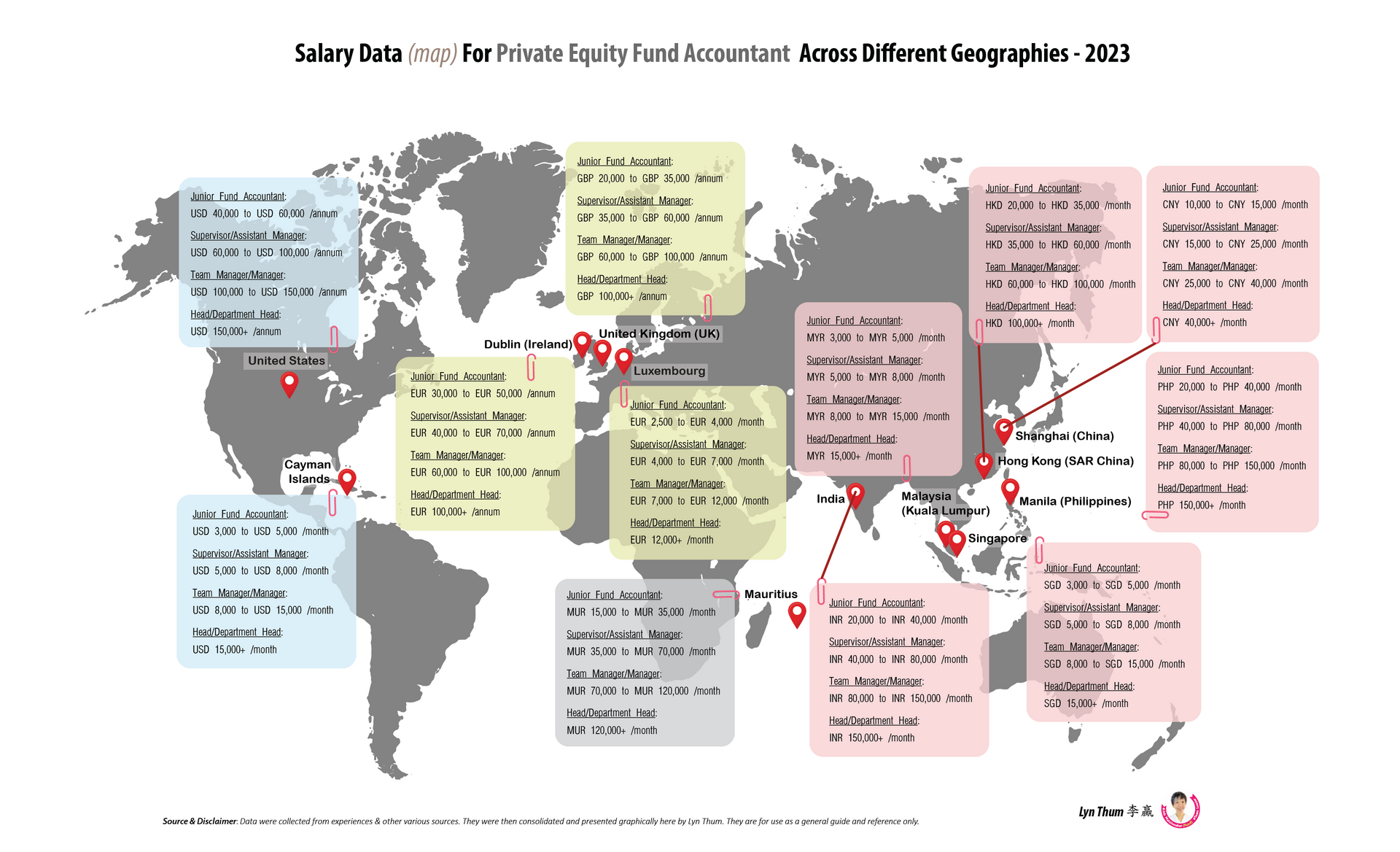

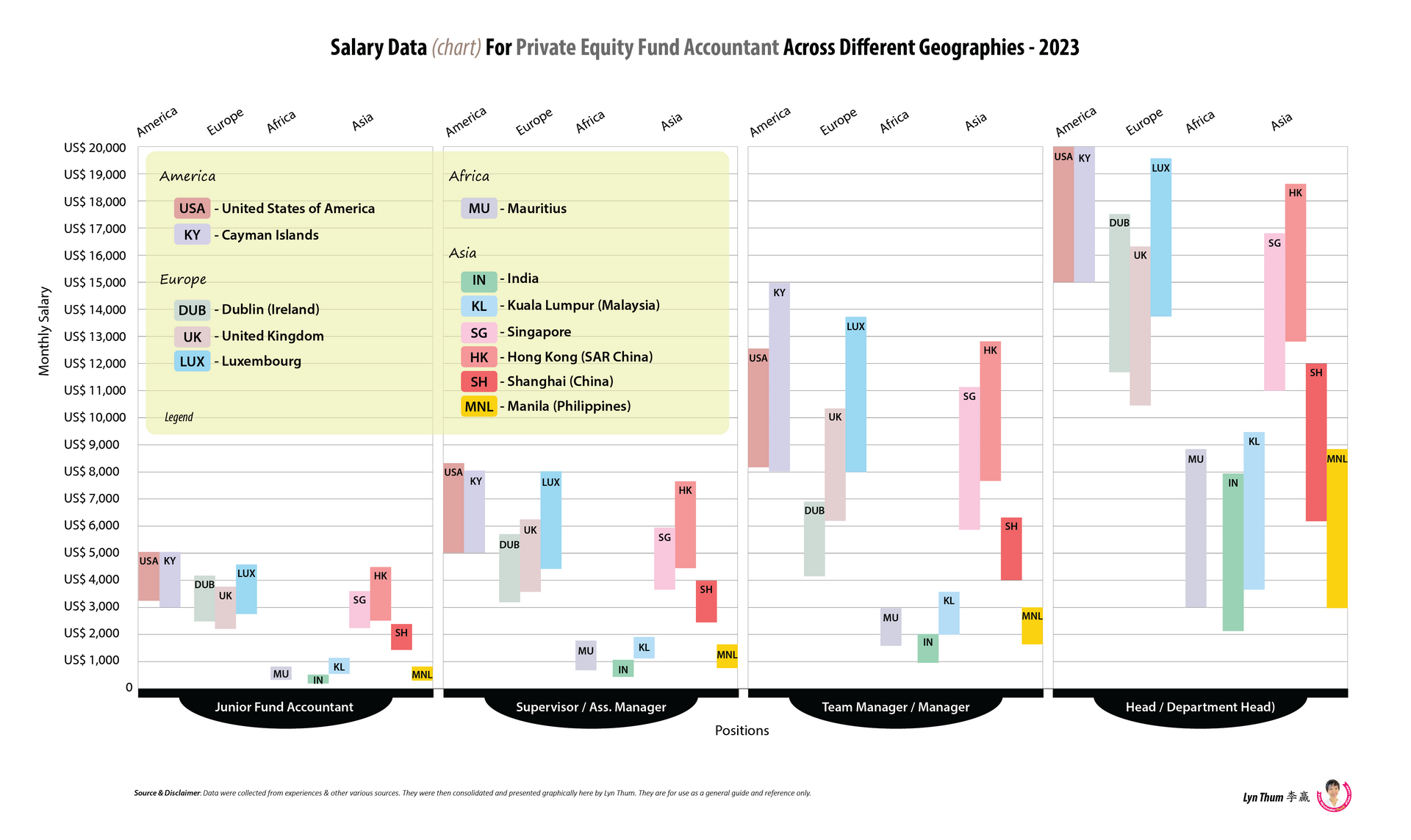

To help with decision-making, I have created a salary data guide for different locations.

Please keep in mind that this guide offers general information and does not account for currency conversion or specific salary payment periods (such as 13th or 14th-month salaries). The data has been converted to USD and adjusted to represent a 12-month salary payout period for easier comparison.

Please note that the information provided is not official but rather a compilation of data points from various sources.

The chart serves as a starting point and should be used as a reference only. It is essential to conduct further research and analysis to make informed decisions based on your specific needs and circumstances.

Whether you are planning to

offshore, nearshore, friendshore, or simply looking to learn more about the fund talents space, please feel free to reach out. I would be happy to provide further insights and sharing.

Understanding the cost landscape and having access to reliable data is crucial for organizations looking to optimize their operations and remain competitive in today's dynamic business environment.

Download the PDF version here: Private Equity Fund Accountant Salary Data - An Informal Compilation by Lyn Thum

About the Author

Share This Article

Articles You May Like