Latest Insights

February 27, 2023

Director's Note

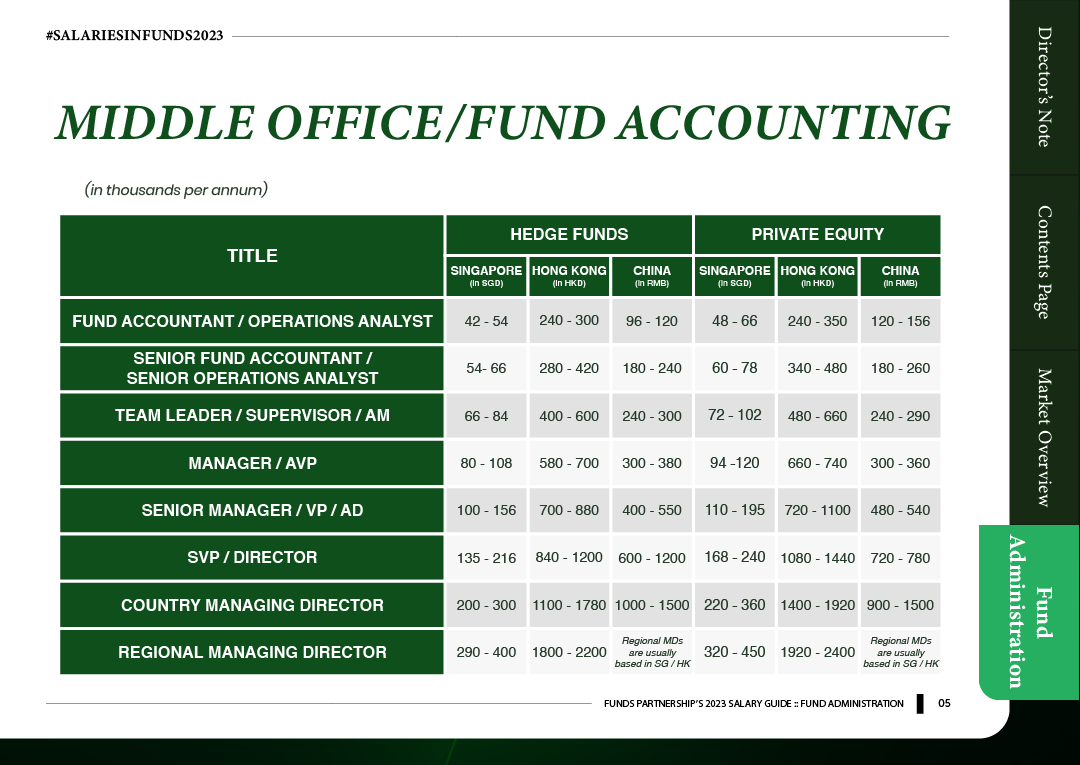

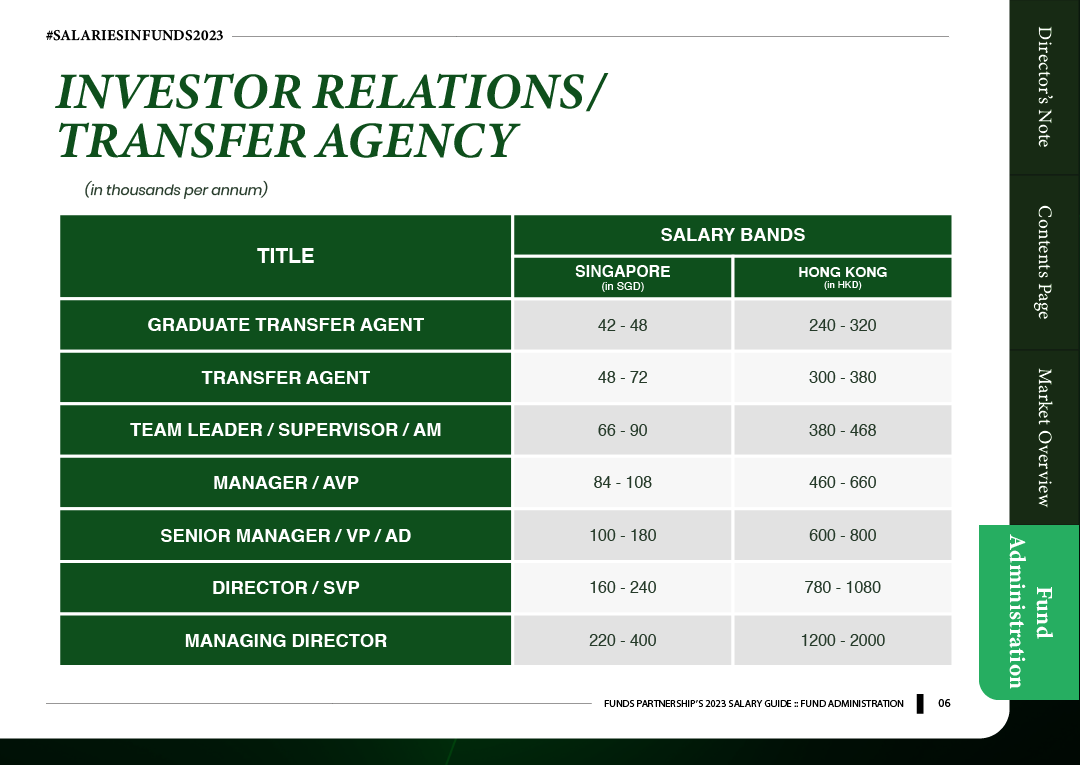

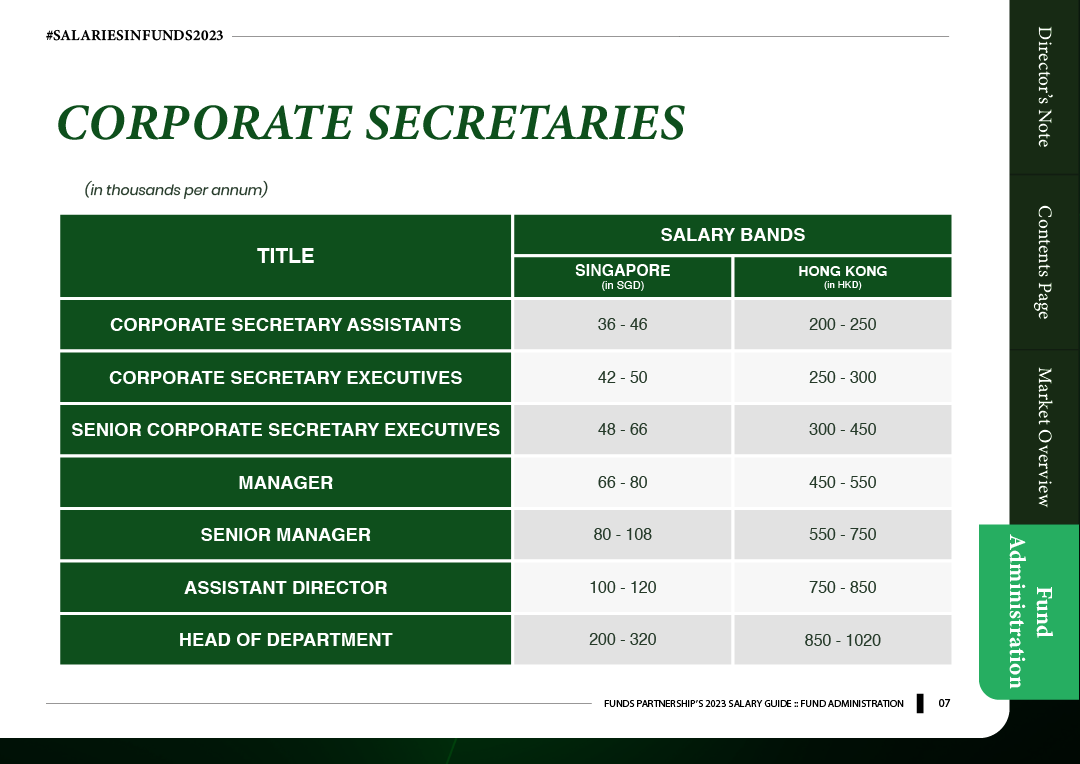

The Asia Pacific region continues to be a major player in the global asset servicing and fund administration industry, with strong growth and high demand for skilled professionals. Our Asia Pacific salary guide provides a comprehensive overview of the latest salary trends for this industry, including key job roles and markets across the region.

Within the asset servicing and fund administration industry, we have seen a high demand for professionals in areas such as fund accounting, custody, transfer agency, and middle office operations. In addition, there is an increasing focus on ESG investing, diversity and inclusion, and technological expertise. This has led to a growing need for professionals with skills and expertise in these areas, as well as a willingness to adapt to new technologies and processes.

Compensation packages for top talent in the asset servicing and fund administration industry continue to be highly competitive, with many firms offering generous benefits and incentives to attract and retain top candidates. Our salary guide provides a comprehensive overview of the latest salary trends for key job roles and markets across the region, as well as insights into other factors that impact compensation, such as education level, years of experience, and professional qualifications.

At Funds Partnership, we are committed to helping our clients stay competitive in the rapidly evolving asset servicing and fund administration industry. Our Asia Pacific salary guide is an essential resource for firms looking to attract and retain top talent, and stay up-to-date with the latest industry trends and best practices.

Market Overview

Despite the pandemic, the Fund Administration industry has seen tremendous growth in the past years and is projected to expand continuously.

Fueled by the launch of the Variable Capital Company (VCC) structure in 2020, we have observed an influx of funds and Family Offices setting up in Singapore, with a focus on Private Equity and Real Estate funds. Fund Administrators that were initially focused on Mutual and Hedge funds have also started migrating their operations offshore while pivoting their focus to Private Equity and Real Estate funds.

In the past year, we have seen a rapid increase in demand for talent in this space. As the market gets increasingly competitive, plug-and-play candidates are demanding over 20% salary increments for their next move. In order to retain their employees, employers are also conducting salary reviews to stay competitive in the market.

In this report, we would like to share the prospects of this market through the compilation of our data and the future developments of the industry.

Salary Guide

Download the PDF version of the Funds Partnership 2023 Fund Administration Salary Guide here: Funds Partnership 2023 Salary Guide: Fund Administration

To find out more about the Fund Administration industry, get in touch with our specialist:

Articles You May Like

Talent is King (and Queen) in Alternatives: Insights from the 2024 EY Global Alternative Fund Survey

Capabilities

Executive Search

LEADERSHIP TRAINING & CONSULTANCY

People

Expertise

FP GLOBAL PTE. LTD. Licence Number: 22C0953