Latest Insights

March 13, 2023

Director's Note

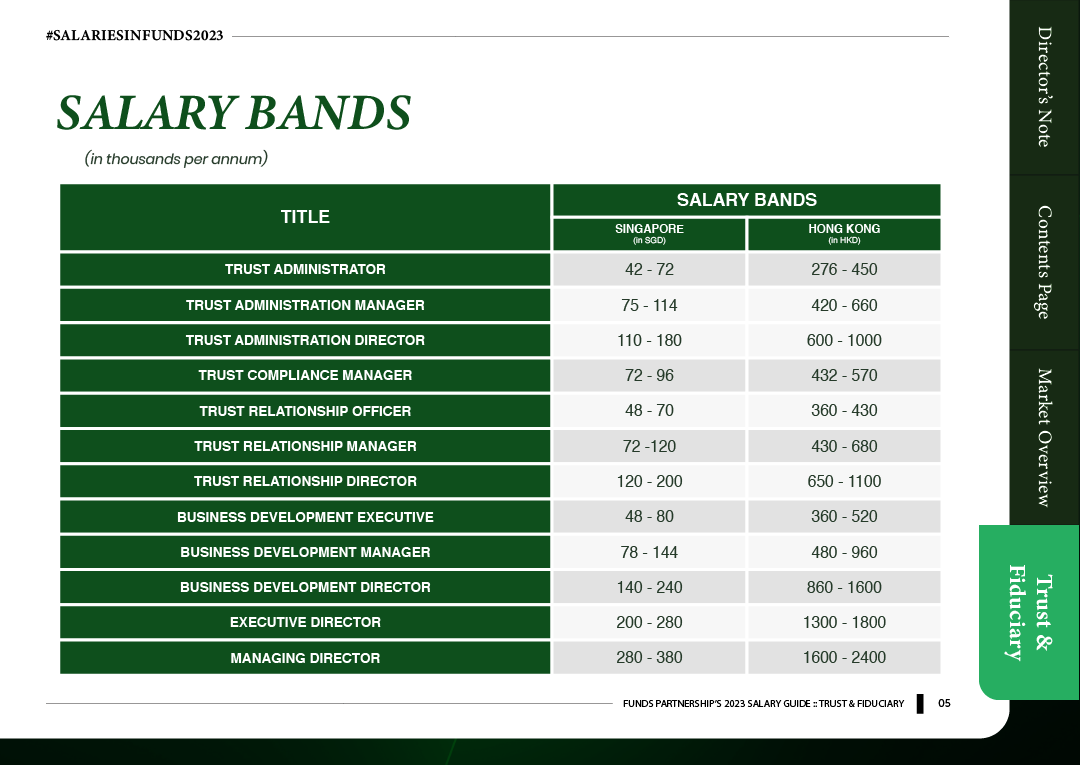

The Asia Pacific region continues to be a major player in the global asset servicing and fund administration industry, with strong growth and high demand for skilled professionals. Our Asia Pacific salary guide provides a comprehensive overview of the latest salary trends for this industry, including key job roles and markets across the region.

In recent years, we have seen a growing trend towards offshoring to countries such as Malaysia, the Philippines, India, and Mauritius. While this has led to increased efficiency and cost savings for many firms, it has also impacted the job market in the region, with some roles being outsourced to these offshore locations. Nevertheless, there remains a strong demand for talent across the industry, with a particular emphasis on data analytics, technology, and regulatory compliance.

Compensation packages for top talent in the industry continue to be highly competitive, with many firms offering generous benefits and incentives to attract and retain top candidates. Our salary guide provides a comprehensive overview of the latest salary trends for key job roles and markets across the region, as well as insights into other factors that impact compensation, such as education level, years of experience, and professional qualifications.

At Funds Partnership, we are committed to helping our clients stay competitive in this rapidly evolving industry. Our Asia Pacific salary guide is an essential resource for firms looking to attract and retain top talent, and stay up-to-date with the latest industry trends and best practices.

Market Overview

As the world is returning to normal after the disruption of the COVID-19 pandemic and the economy fully opened up, the Trust industry has seen an uptick of interest globally not only from Asia but also Europe and America. 2022 has, however, brought alongside further uncertainties while recovering from the pandemic. While geopolitical unrest has devastatingly impacted businesses as markets rattled and inflation surged, ultra-high-net-worth clients and families have thus faced greater complexity than ever. The challenges and complications arisen have significantly impacted numerous affluent individuals and families to reconsider the importance of ascertaining proper succession planning is in place to ensure the effective transfer and preservation of wealth to better prepare against future uncertainty.

Aligning with this trend, more super-rich families are setting up offices in Singapore with the number of such offices nearly doubling from two years ago, to manage their wealth and address their other utmost concerns which include family governance, health and portfolio diversification. This influx of businesses has translated to a higher demand for qualified and experienced talent with close ties and networks to penetrate and cater to this highly specific and dynamic market. Against this highly competitive backdrop, employers are paying top dollars in this candidate-short (and driven) market to fill these positions within their ranks. Aside from struggling to fill open positions, employers are also battling high turnover rates which lead to an increased focus for companies to look into retaining their talents via industry-benchmarked packages and implementing employee-focused initiatives to enhance their experience, engagement and retention.

As a specialist in this sophisticated industry, we have compiled this Salary Guide to help employers to start on the right foot and attract and retain great talent in 2023.

Salary Guide

Download the PDF version of the Funds Partnership 2023 Trust & Fiduciary Salary Guide here: Funds Partnership 2023 Salary Guide: Trust & Fiduciary

To find out more about the Trust & Fiduciary industry, get in touch with our specialist:

Articles You May Like

Talent is King (and Queen) in Alternatives: Insights from the 2024 EY Global Alternative Fund Survey

Capabilities

Executive Search

LEADERSHIP TRAINING & CONSULTANCY

People

Expertise

FP GLOBAL PTE. LTD. Licence Number: 22C0953